2021 was a costly year for the global economy, as the aftermath of the COVID-19 pandemic and various natural disasters cost insurers around the world over $130 billion USD. Many IT leaders in the insurance industry are turning to data observability as a way to help optimize their data operations and reduce costs.

When businesses are still reeling from the onslaught of economic slowdowns, the need for enterprises to leverage their arsenal of intellectual property becomes imperative for survival and success. One such internal commodity is data.

A study by McKinsey showed that data-driven organizations are capable of increasing customer acquisition metrics by 23x. Data can mean different things for different entities or verticals. For Marketing teams, it carves a path for efficient customer engagement and acquisition, and for Internal Operations, data can help improve processes to reduce costs or eliminate redundancies. And without the right/accurate data, bottlenecks across these processes can lead to potential roadblocks.

To understand the importance of data and data quality for insurance providers, we need to first understand where all data comes into play for them.

How does data help insurance providers?

Data has shown significant promise for insurance providers. Big data and data analytics has helped insurers increase revenue, retain customers, and improve processes to boost customer satisfaction. To understand how data quality plays an important role, we need to first understand how data on the whole can help insurers overcome growth pains and customer retention/acquisition bottlenecks.

Lead generation

Insurance companies offer a catalog of products that cater to diverse individuals, businesses, and requirements. In the digital age, insurers are constantly locking horns with competitors and emerging startups for a bigger slice of the customer base. In such a scenario, data products help insurance providers gain critical insights into the customer journey, right from the nurturing stage to policy renewal.

By extracting insights into the buyer journey, insurers can study in detail demographics, policy-based roadblocks, and why customers tend to drop off right before completing a purchase. This helps them tailor-make policies to increase the chances of conversion. And by understanding the customer journey, insurance providers can improve customer interactions to increase the chances of renewals.

Underwriting risk analysis

Underwriting is a crucial step in the insurance disbursal process. Underwriters usually utilize a range of software/tools to plot risk factors to accurately arrive at an ideal policy premium. The quality of data flowing into these big data applications and tools eventually determines the accuracy of premium calculation.

For example, an individual is looking to renew their auto insurance policy. Data regarding accident history, service/maintenance routines, and traffic violations are fed into applications to calculate coverage risks. If the data flowing into these applications are corrupted, duplicated, or inaccurate, the premium calculation will subsequently be erroneous, posing a serious financial risk for insurance providers.

Fight fraudulent claims

Fraudulent claims continue to plague insurance service providers globally. In a detailed report by the United States Federal Bureau of Investigation (FBI), insurance fraud accounts for over $40 billion in losses each year (excluding healthcare).

With the arrival of data analytics and predictive modeling, it becomes easier to analyze fraudulent claims by parsing through documents and verifying them against reports filed by agents and government authorities. Over here, the quality of data ingested into big data applications becomes the relevant cause for concern. Unverified documentation and erroneous reports can lead to the disbursal of fraudulent claims.

Eliminating guesswork

An important element in the operational pipeline of insurance providers is the ability to quantify risk levels and their impact on business growth. Earlier, insurance providers relied heavily on guesstimates to measure risks. Today, with the help of data and analytics tools, insurers can predict marketing outcomes and mitigate operational risks without having to rely on assumptions.

Boosting custom satisfaction (CSAT)

CSAT scores have become a critical component of every single enterprise and business across the globe. A superior CSAT score can become the final layer of diligence for customers, thereby separating organizations from their competitors.

However, since there are multiple channels through which an enterprise can interact with its customers, customer data coming into the cloud or on-premises data systems can get stretched. This often leads to pipeline breakdowns, which in turn leads to faulty customer data profiles (CDP) that ultimately affect marketing initiatives.

What’s the roadblock?

For the most part, insurance companies still function as an ‘ink-to-paper’ type of entity. A majority of customer-centric documentation exists in the physical format, which makes the transition to digital documentation difficult.

Moreover, with physical paper, the conversion of paperwork into digital copies can often result in incomplete updating, duplication of data, and human errors. Insurance service providers also deal with large volumes of data, which can be a contributing factor to data pipeline chokes or breakdowns.

The entire quality vs. quantity debate has long been a talking point for businesses. Whilst enterprises have figured out how to absorb more data daily, the quality of the data being ingested has become critical. Hence, Data Observability emerged to address this burgeoning crisis.

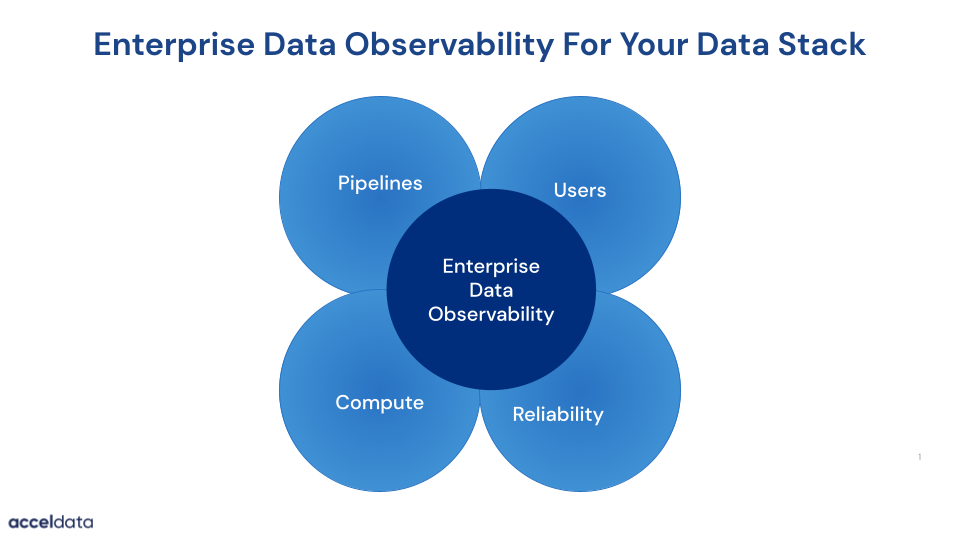

To address the business problems of the 21st century, Acceldata has introduced the concept of multidimensional data observability. Stretched across four pillars, our suite of Data Observability tools helps address data problems across the: 1. Pipeline layer, 2. Compute layer, 3. Reliability layer, and 4. User layer.

What this does for Insurance providers is that it:

✔ Ensures data flowing across diverse channels and pipelines are monitored in real-time, alerting users in the case of potential breakdowns.

✔ Deliver insights into analytical tool expenditures, which brings about superior financial operations governance.

✔ Solve data reconciliation and schema drift issues to combat data manipulation and erroneous entries that result from human error or claims fraud.

✔ Provide a 360-degree view into the quality of data that is required across the organizational infrastructure (such as Data Engineers, Architects, Analysts, CDOs, etc.).

Acceldata has been identified as a market leader in this space, having helped renowned organizations like Oracle, Dun & Bradstreet, Verisk, and PhonePe manage data pipelines more efficiently. Either on the cloud, on-premises, or hybrid, Acceldata’s suite of data observability solutions helps eliminate the potential risks associated with data quality errors and data pipeline breaks by monitoring them constantly and alerting teams in advance.

Contact us to learn more about how data observability can support your organization.

Photo by Simone Hutsch on Unsplash

.png)

.png)

.webp)

.webp)